Introducing Match Plus

Match Plus is FuturePlanner’s new contribution structure that helps you save even more into your pension. From 1 April 2024, it replaces two-for-one.

Match Plus in a nutshell

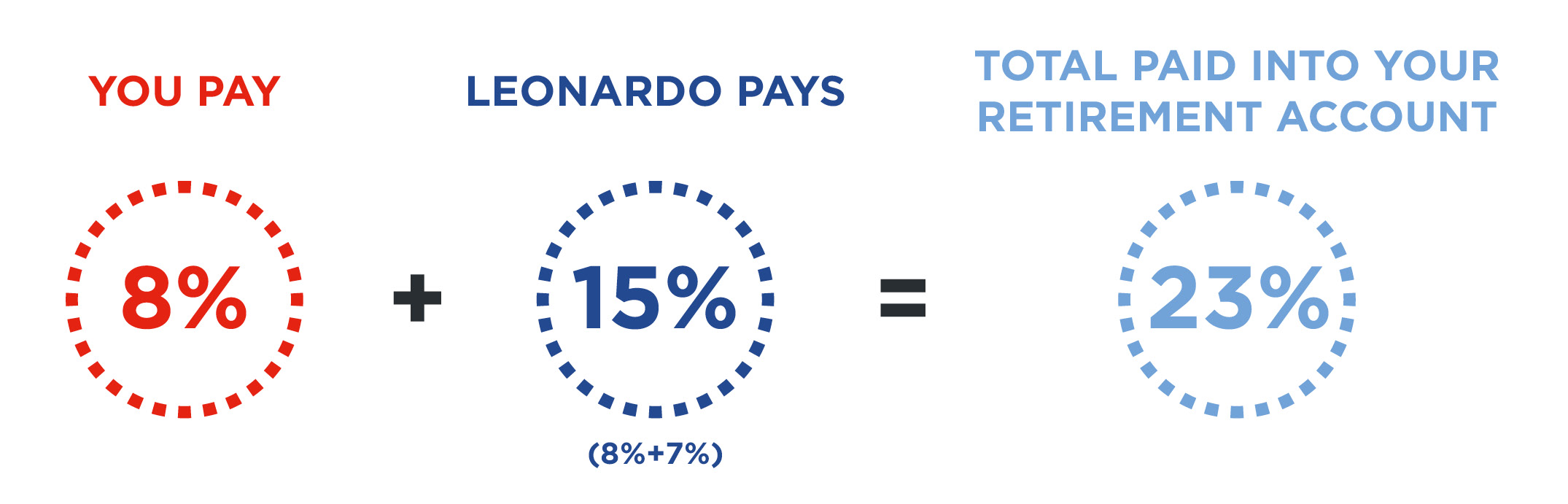

Leonardo will match your contributions up to 8% – plus add a contribution boost of up to 7% – depending on how much you decide to pay. This means that the new maximum Company contribution that’s available goes up from 10% to 15%.

How it works

What you pay in is up to you. The more you decide to pay, the higher your Match Plus contribution boost will be (up to a maximum of 15%). To get the maximum Match Plus contribution from Leonardo, you’ll need to pay in 8% of your Pensionable Salary. The Company will match your 8% plus add a further 7% bringing the total from Leonardo to 15%.

Anything you contribute above 8% is counted as Additional Voluntary Contributions (AVCs), which are not matched but go into the same Retirement Account.

| Your contribution |

Match Plus rate |

Company contribution |

Total |

|

1%

|

+2% |

3% |

4% |

| 2% |

+4% |

6% |

8% |

| 3% |

+6% |

9% |

12% |

| 4% |

+7% |

11% |

15% |

| 5% |

+7% |

12% |

17% |

| 6% |

+7% |

13% |

19% |

| 7% |

+7% |

14% |

21% |

| 8% |

+7% |

15% (max) |

23% |

| 9% |

+7% |

15% |

24%+ |

Want to change your contribution rate?

To select your first contribution rates under the Match Plus structure from April 2024, eligible members will have received a communication from XPS Administration with directions to an online contribution selection tool which is available until 29 February 2024.

After April 2024, simply log in to your online account at www.mypension.com/futureplanner and update your contribution, or complete a contribution change form, giving one month’s notice.

Pensionable Salary

Your pensionable salary has changed and is now your basic salary and any permanent shift allowance you may receive.

Match Plus tool

Keep an eye out in February for our new Match Plus tool. You can use it to work out how much you could save into your Retirement Account each month and the actual cost to you, once tax and National Insurance savings are taken into account – it’s less than you might think.